Learn everything you need to know about SAC Finance, a structured alternative credit finance solution offering businesses flexible funding options. Explore how SAC Finance works, its benefits, and its growing role in modern investment strategies and project financing.

SAC Finance: Step-by-step guide towards understanding SAC finance and its importance in the financial world

Introduction

In the world of finance, the terms and acronyms can be quite confusing for people who want to understand the different aspects of the industry. One of them is the term “SAC Finance.” Whether you are a new one who wants to grasp what finance is or someone who has been in this field for a while but does not understand what SAC Finance is, this article will guide you as your ultimate path in understanding this very aspect of the financial landscape.

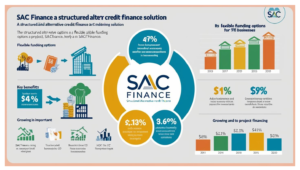

SAC Finance is a term that represents Structured Alternative Credit Finance. It is an emerging concept in finance and has primarily been devised to address financing challenges of markets in which the regulatory and economic dynamics as well as the preferences of investors continue to change. SAC Finance brings the best of structured finance, alternative lending, and the traditional banking systems to be a hybrid solution that appeals both to investors and to companies.

In this article, we will be talking about what SAC Finance is, its functionality, advantages, use of the same, and what lies ahead of SAC Finance regarding evolutionary finance markets. Some questions would also be addressed, as this would enhance depth into your understanding about SAC Finance.

READ MORE ARTICLES RELATED TO FINANCE:Understanding Rekey in Finance: A More Comprehensive Explanation

What is SAC Finance?

SAC Finance is the design of finance targeted toward offering access to capital other than in conventional routes through banking. This instead happens to be a model of new finance, which includes credit arrangements structured such as securitizations and special-purpose vehicles for the purpose of funding provision from investors to businesses or projects.

SAC Finance is not like the traditional bank loans and usually deals with entities or projects that would be considered to have a higher risk and conventional financing may not be readily available. The aggregation of different forms of capital creates more flexible options for businesses in terms of seeking financing, and, conversely, for investors looking to expose themselves to non-traditional credit opportunities.

SAC Finance basically encompasses a blend of alternative credit mechanisms and structured finance solutions for its customers borrowing but bringing to its investors a diversified portfolio that oftentimes is better yielding in the process.

The Main Components of SAC Finance

Structured Finance: Essentially the design or the engineering of financial products or arrangement involving products that would be the bonds, securities on which these debt instruments would be embedded so as to distribute their risks among parties.

Alternative funding sources. Using funds from such entities as hedge funds, private equity firms, and even other types of people as an additional source of funding to prevent a heavy concentration of risk on their loan exposure base.

Credit risks analysis and regulation

since it has to focus on non-traditional lending, the firm needs a more developed evaluation compared with typical credit risk models

SAC Finance Mechanism

SAC Finance primarily conducts its operations through structured products which enable raising funds for a particular project or company. The financial structure is set up to serve all manner of financial needs, such as acquisition and mergers, project financing, and growth capital.

This is how SAC Finance usually works step by step:

1. Setting up Special Purpose Vehicles (SPVs)

An SPV is structured such that the financial risk associated with the project or business that is raising funds is separated from the same risk. It gives an independent legal identity, thus funds can be raised in this vehicle while keeping the entire balance sheet of the borrowing entity completely untouched.

2. Pooling of Assets

This is often done by pooling together various assets or future cash flows to form the collateral on which SAC Finance is founded. It may include property, revenues, or even contracts to be sold in the financial market.

3. Issuance of Securities

Having formed the SPV and acquired the assets, a security like bonds or asset-backed securities or notes is then issued to investors that represents claims on future cash flows from the project or business.

4. Investors’ Investment

The said securities are bought by investors, which can be a hedge fund, private equity firm, or institutional investors. This is through periodic payments depending on the performance of the underlying assets.

5. Pay-out of Earnings

The monies received from the issuance of the securities will be channeled to finance the underlying project or business. Upon attainment of revenue from the project, the money realized will be used to refund the investor through interest or dividends-type repayment.

6. Repayment and Exit Strategy

As the debt is repaid, it is the time of the collection of principal and interest, and capital gain opportunities will be subjected to increase in value from the underlying assets. This might be how an exit is created on the invested returns.

Advantages of SAC Finance

SAC Finance has given a couple of advantages for the lender and borrower. The given are some of the very basic benefits from the SAC Financial model.

1. Non-traditional Access to Capital

SAC Finance provides businesses with access to capital outside the traditional channels of the banking system. This makes it a great alternative for businesses that may find it challenging or impossible to obtain conventional bank loans.

2. Customized Financial Solutions

SAC Finance offers tailored loan packages for the borrowing of every borrower. A business can bargain a better deal with their lenders in getting low interest rates and having a flexible form of paying off the loan.

3. Flexibility

SAC Finance is easily adapted to the specific requirements of a project. Consequently, it is more convenient than traditional finance. Structured finance gives entities the opportunity to address specific needs, for instance, long-term ventures and mergers and acquisitions.

4. Higher Potential Yield to Investors

To an investor, SAC Finance offers avenues through which an investor can achieve higher returns than he or she may have obtained from more traditional forms of investment instruments. In general, structured finance instruments are relatively riskier but offer higher.

5. Risk Distribution

The point with SAC Finance is to spread risks to different parties. Its aggregate of various assets or sources of fund would make possible the minimization of different possibilities of risks with divergent possibilities of diversifications to far more comfortable portfolios.

6. Quick funding solution

Most traditional loan applications, as such, take forever. Business owners may, for this reason, feel it easier with SAC finance since investors can be liberal and elastic in their terms.

Apps for SAC Finance

SAC Finance is increasingly applied in various industries and situations where traditional financing is not feasible or available. The main applications are as follows:

1. Real Estate Development

In real estate, SAC Finance can be used to raise funds for large-scale projects such as residential complexes, commercial real estate, or infrastructure development.

2. Mergers and Acquisitions (M&A) Companies that perform M&A transactions usually raise funds for acquiring or merging with other companies through SAC Finance. This is because SAC Finance has flexibility and can be tailored to meet the needs of complex financial deals.

3. Infrastructure and Energy Projects

The financing of major infrastructure and energy projects is quite significant. SAC Finance helps investors pool their resources together and take the financial risk associated with large-scale projects.

4. Private Equity and Venture Capital

SAC Finance is extremely popular in the private equity and venture capital sectors. High-risk investment always needs specialized credit and funding solutions.

Prospects for SAC Finance

Bright prospects of SAC Finance, with the constantly changing face of finance, and under a stricter regulatory environment which is affecting traditional banking systems, businesses seeking funding would always find more attractive alternatives in SAC Finance.

This is an increased demand in alternative investments and structured products that will reflect demand for SAC Finance. In addition, because technology and data analytics continually advance, managing risk continuously evolves and improves for the delivery of businesses and investors with the most advantageous form of SAC Finance.

Conclusion

SAC Finance is indeed an effective and flexible means of financing that addresses business capital needs outside the systems of traditional banking. Its capacity to structure deals that meet the specific needs of business or a project makes it an alternative for companies with a need for funding.

SAC Finance has the prospect of accessing high-yielding, alternative credit instruments besides diversifying the investor’s portfolio. With the structured finance and alternative lending experience growing, it is probable that the scope and reach for SAC Finance will increase such that it will be part and parcel of the entire financial ecosystems in the world.

With increased demand to gain access to financing, and investors wanting better returns, SAC Finance will become a vital element in the financial market. As a business owner, investor, or financial professional, you must be aware of SAC Finance if you’re going to have any idea where your future is going in finance.

Frequently Asked Questions About SAC Finance

1. What’s the difference between SAC Finance and traditional financing?

SAC Finance is distinct from traditional financing because it contains structured credit arrangements and other sources of credit that are not based on conventional loans from a bank. It can be much more flexible and tailored to the borrowers and investors.

2. What is the structure of SAC Finance?

SAC Finance is generally an SPV in which the financial risks are differentiated for a specific project, with aggregated assets, issued securities, and distributed returns to investors.

3. What is the class of investors which can avail the benefit of SAC Finance?

SAC Finance is very helpful to business enterprises engaged in real estate, infrastructure, and private equity. In all the above cases, companies may not qualify through conventional loans, or even may need special financial solutions to satisfy their requirements.

4. What type of securities does SAC Finance uses?

The securities in the SAC Finance may comprise various securities such as bonds, asset-backed securities, and notes that may trickle to investors. There are risks associated with the SAC Finance as explained below.

5. What are some of the risks associated with SAC Finance?

The risks in SAC Finance include credit risk, market risk, and liquidity risk. Investors may face losses if the underlying assets do not perform as expected. However, diversification and sophisticated risk management strategies are used to mitigate these risks.

6. Is SAC Finance a new concept?

Although SAC Finance is a recent innovation, the core ideas it is founded on have their roots in long-standing practices in structured finance. It has recently experienced growth as demand for alternative credit solutions increases.

7. Can SAC Finance be applied to personal loans?

Normally, SAC Finance is not applicable for personal loans. Its applicability is more so on big projects or financing a business. However, in some conditions, the elements of SAC Finance can be applied to consumer finance.