Discover how a pool financing calculator can help you plan your pool installation. Learn how it works, types of financing options, and tips for using it effectively to estimate monthly payments and loan costs.

Pool Financing Calculator: Comprehensive Guide

A swimming pool is often considered a luxury but can also be wise as an investment in relation to relaxation, exercise, and increasing the value of your property. However, installing a pool can have significant costs, and so, for many homeowners, the question is how they are going to afford this investment. However, there is a solution to pool financing, which includes tools that aid in the process: for example, the pool financing calculator. The pool financing calculator can help determine how much one could borrow, what payments would be each month, and what financing options were best suited for specific needs.

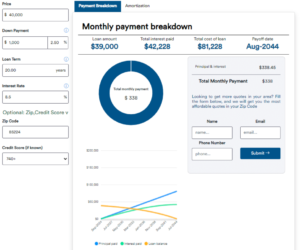

A pool financing calculator is a computer-based assistant in estimating the cost to finance a swimming pool to prospective pool owners. All the following can be calculated: the monthly payments, interest rate, loan term, and total cost of borrowing. The calculator can assist in determining which would best fit your financial condition, whether it is through a home equity loan or some other type of loan.

This tool considers such critical factors as follows:

- Loan Amount: The money that you borrow to fund the pool installation.

- Interest Rate: the APR that the loan bears.

- Loan Term: How long you take to repay the loan.

- Monthly Payments: the amount that you will be required to pay every month.

- Total Loan Cost: the actual cost of the loan and the interest paid.

You can input your loan details into a pool financing calculator to arrive at a proper calculation of the monthly payments and the total amount for the loan.

How a Pool Financing Calculator Works

A pool financing calculator is a simple tool using some basic financial formulas, in which it calculates monthly payments based on the loan amount, interest rate, and term. The formula is an adaptation of the standard amortization formula, divided into equal monthly installments in the repayment process.

Step-by-Step Process

Amount to Borrow Enter how much you believe you will borrow overall. This would represent the whole cost for installing your pool including its construction, equipment and anything else.

- Select Loan Term: In a loan, a term represents how long you will be paying the loan. Traditional conventional pool loan terms range 5-20 years in duration. You will pay a higher amount per month and, yet, will pay lesser interest if the duration for your loan was short; and, you will make less payments per month for a much more extended period but significantly higher interests paid in case your tenure in the loan was lengthy.

- Input Interest Rate: This will be the APR your lender would charge you annually. It depends on several conditions like your credit rating, type of loan, and lender with whom you are dealing.

- Review Your Monthly Payment: Once all of the details are entered into the pool financing calculator, it will give you an estimate of your monthly payments. The amount will include both the principal-the amount borrowed-and the interest charged by the lender.

- Calculate Total Loan Cost: Finally, the calculator will give you an estimate of how much it will really cost in terms of principal and interest. This gives you a better idea of what it will cost to finance your pool long-term.

Why Use a Pool Financing Calculator?

This is one of the most essential calculators for any individual seeking to finance a pool installation. Below are several reasons why its usage is necessary before decisions are made:

1. Estimating Monthly Payments

It allows using a pool financing calculator to quickly determine how much your monthly payments will be based on the amount that you plan to borrow and the loan terms. This way, it guides whether you can afford the payments based on your budget.

2. Compare Different Financing Options

You can take a home equity loan, personal loan, or seek financing through your pool contractors. Each may have its interest rates and terms. This can be compared by a pool financing calculator to find the most favorable based on your financial needs.

3. Know the total loan costs

While it is easy to think in terms of the monthly payments, you need to take into account the whole cost of the loan throughout the term of the loan. A pool financing calculator helps one get out of that trap of thinking the first payment is all there is to make your commitment much clearer.

4. Do not over-borrow

A pool financing calculator can help you to borrow only the amount that you want to. As soon as you provide realistic numbers, you will be able to preview your estimates of a monthly payment and thereby ensure that the loan amount you are soon to obtain is apt to your circumstance.

5. Plan for the Future

The amount of burden on your finances will be known in advance using a pool financing calculator. That way, you will know how much to put in your budget every month and whether this is the good choice to take on a pool loan in the long run.

Types of Pool Financing Options

There are so many options on financing pool loans. But all have their pros and cons, so you can choose to suit your pocket and much you intend to take.

1. Home Equity Loans

Pool financing can be done in one of the most famous ways: through a home equity loan. They usually have the advantage of lower interest than an unsecured personal loan because you secure the loan with your home. However, this comes at the risk of foreclosure when you are unable to return the loan.

2. Personal Loans

Personal loans are unsecured loans, meaning they do not require collateral. They normally have higher interest rates than home equity loans but are good for those who do not want to risk their home.

3. Pool Financing through Contractors

Some pool contractors have financing options available directly from the contractor due to their partnerships with lenders. The loans are convenient because they are specifically for pool installation, but review the terms carefully because interest rates might be higher than traditional lenders.

4. Credit Cards

Some homeowners use credit cards to finance small pool projects. Credit cards carry high interest rates; make sure you can pay off the balance quickly, so you don’t get hit with significant interest charges.

5. Cash-out Refinance

A cash-out refinance involves refinancing your mortgage to take out extra cash for pool installation. While this may offer lower interest rates than other options, it also increases your mortgage balance, which means a longer repayment term and potentially higher monthly payments.

How to Use a Pool Financing Calculator Effectively

To get the most out of a pool financing calculator, follow these tips:

Get as much accurate information as possible before entering the numbers: The closer you are to your true situation, the closer to that will come out of your results. Some things to make sure you have for starters are the total cost of the pool, what interest rate you are quoted, and how long you’re offered the loan for.

Use Different Terms and Amounts: Using this calculator, you can play with different terms and amounts. You might discover that a little shorter loan term will drastically reduce the cost of the loan although you will be increasing the amount you pay each month.

Remember that there are extra costs while budgeting for your pool, such as the maintenance of the pool, landscaping, and higher utility bills.

Review Your Budget: Before closing a loan, review your monthly budget to ensure that the monthly payments will fit comfortably within your financial means.

Conclusion

A pool is a great feature for the house, but funding it requires much contemplation. A pool financing calculator helps estimate options and predict what it will cost in monthly payments beforehand and thus make an evaluation of the whole cost of the loan. Proper use of the calculator allows one to better assess decisions to avoid too much debt.

Before you settle on a pool financing option, always consider reviewing all available pool financing choices, and comparing their terms, loan rate, and ability to pay their monthly bills. All in all, a prudent pool financing approach will leave you to live with the pool without a single care or stress related to the spending.

FAQs

1. How accurate is a pool financing calculator?

Pool financing calculators make an estimate based on what you input. They tend to be pretty accurate, but loan terms and payments will differ based on the lender and your financial situation.

2. Can I use a pool financing calculator for other types of loans?

Yes, most pool financing calculators can also be applied to other loans, for example, personal loans or home equity loans. You can just enter the correct terms and loan amounts.

3. Which financing option will suit me best?

The best financing option depends upon the amount to be borrowed, credit score, and the length of time it would take to repay the loan. This pool financing calculator helps you compare all these options depending upon your needs.

4. What happens if I do not have enough money for monthly payments?

If you are not able to pay your monthly installment, then you should contact your lender in order to discuss your possible options. You may possibly refinance or adjust your loan terms to make it easier to pay for it.

5. Do I need good credit to finance a pool?

Good credit will earn you a good interest rate. Even with bad credit, you can finance your pool, but with the cost of higher interest or more stringent loan terms.

There are several official websites and platforms dedicated to pool financing that offer loans, calculators, and financing solutions specifically for pool installation.