Tesla Model 3 Lease vs. Finance: Which Option is Right for You?

When you’re considering getting a Tesla Model 3, the decision to lease or finance can be a tricky one. Both choices offer different financial advantages and challenges, and understanding the ins and outs of each can make a big difference. Whether you’re a tech enthusiast dreaming of the electric future or just want a sleek, high-performing vehicle, this article will help you navigate the pros and cons of leasing vs. financing so you can make a well-informed decision that suits your needs.

Leasing a Tesla Model 3: Is It Right for You?

Leasing a Tesla Model 3 means you’re essentially renting the car for a set period, typically 24 to 36 months. You make monthly payments during that period, but at the end of the lease, you return the car and walk away. You don’t own the car, but you get to drive a brand-new vehicle without the long-term commitment.

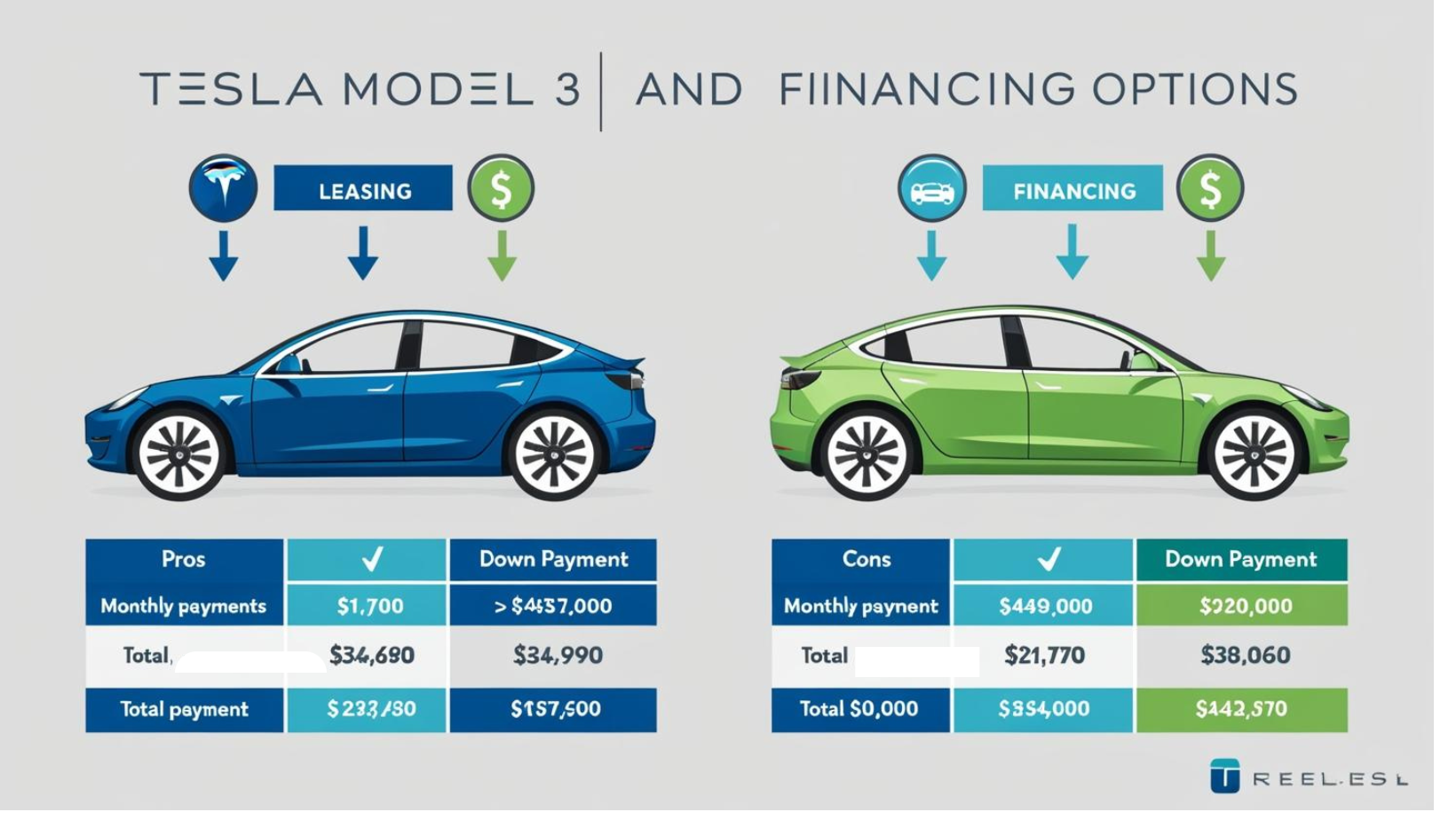

Pros of Leasing

- Lower Monthly Payments: Leasing usually comes with smaller monthly payments compared to financing. This makes it easier to drive a luxury car like the Tesla Model 3 without stretching your budget too far.

- Little to No Down Payment: Most leases require little upfront cost, which means you don’t need to fork out a huge lump sum at the beginning.

- Enjoy the Latest Tech: With leases typically lasting 2-3 years, you get to upgrade to the latest model every couple of years, meaning you always drive a new car with the newest features.

- Warranty Coverage: Since you’re driving a new car for most of the lease, it’s still under warranty, so you won’t have to worry about expensive repairs.

Cons of Leasing

- No Ownership: At the end of the lease, you have to give the car back. You don’t build equity in the vehicle, and if you want to own it, you’ll have to buy it at its residual value, which can sometimes be higher than expected.

- Mileage Limits: Leases often come with annual mileage limits (usually 10,000 to 15,000 miles). If you drive more than that, you’ll face fees for every extra mile.

- Customization Restrictions: When you lease, you’re not allowed to make permanent changes to the car. So, no custom paint jobs or performance upgrades unless you’re okay with undoing them when the lease is up.

- Long-Term Cost: While leasing might seem more affordable at first glance, leasing multiple cars over many years can end up costing you more in the long run than buying one and keeping it for a while.

Financing a Tesla Model 3: The Path to Ownership

Financing a Tesla means you’re taking out a loan to purchase the car. You’ll make monthly payments toward the loan, and once it’s paid off, the car is yours to keep. This gives you ownership of the car and all the perks that come with it.

Pros of Financing

- Own the Car: After you’ve paid off the loan, the car is yours, and you can keep it as long as you want. There’s no pressure to return it at the end of a lease term.

- No Mileage Limits: You’re free to drive as much as you want without worrying about penalties for going over a set number of miles.

- Build Equity: Once the car is paid off, it’s an asset you own, and if you decide to sell it later, you could get some of your money back.

- Flexibility: You have complete freedom with your Tesla. You can customize it, modify it, or just enjoy it without restrictions.

Cons of Financing

- Higher Monthly Payments: Monthly payments for financing are typically higher than leasing because you’re paying off the full price of the car, not just its depreciation.

- Bigger Down Payment: In many cases, financing requires a significant down payment, which could be as much as 20% of the car’s purchase price.

- Depreciation: Like all vehicles, your Tesla will lose value over time. If you need to sell it before it’s paid off, you might owe more than it’s worth.

- Repair Costs: After the warranty expires, you’ll be responsible for any repairs or maintenance, which could be expensive as the car ages.

Choosing Between Leasing and Financing: Key Considerations

When deciding between leasing or financing, you need to think about your lifestyle, finances, and preferences. Here are some things to consider:

- How long do you want to keep the car? If you love the idea of getting a new car every few years, leasing makes sense. But if you plan to keep your car for the long haul, financing will allow you to build equity and drive your Tesla for many years without monthly payments once the loan is paid off.

- How much do you drive? If you drive a lot, leasing might not be the best option because of mileage limits. Financing allows you to drive as much as you want without penalties.

- What’s your budget like? Leasing might be better if you’re looking for lower monthly payments and a smaller upfront cost. Financing, on the other hand, means higher payments but gives you ownership over time.

- Do you want flexibility? Financing offers the most flexibility. You can modify the car, drive it as much as you want, and hold onto it for as long as you like. Leasing has more restrictions but lets you drive a new car more frequently.

Conclusion: Which Is the Right Choice for You?

In the end, the decision to lease or finance a Tesla Model 3 depends on your personal preferences and financial situation. If you’re someone who likes to switch to a new car every few years, keeps your miles low, and doesn’t mind giving the car back at the end of the term, leasing might be the perfect fit. But if you prefer long-term ownership, want the freedom to drive as much as you like, and plan on keeping your Tesla for many years, financing is probably the better option.

No matter which path you choose, you’ll be driving one of the most innovative and exciting cars on the market. So take some time to weigh your options and choose the one that aligns best with your needs and goals.

Frequently Asked Questions (FAQs)

1. Can I lease or finance a Tesla Model 3 with no money down?

Yes, it’s possible. Tesla offers both leasing and financing options with little or no money down, but this could increase your monthly payments.

2. What’s the average lease payment for a Tesla Model 3?

Lease payments typically start at around $399 to $499 per month, but this depends on factors like location, trim level, and lease terms.

3. Can I buy my leased Tesla Model 3 at the end of the lease?

Yes, most leases offer an option to purchase the car at the end of the lease term. The price is usually based on the car’s residual value at that time.

4. Does Tesla offer financing through their own network?

Yes, Tesla offers direct financing options, or you can choose to finance through third-party banks or credit unions.

5. Which option is cheaper in the long run: leasing or financing?

Leasing may be cheaper in the short term, especially with lower monthly payments. However, financing typically works out better in the long run if you plan to keep the car for several years.